British inflation surprised again with a jumpy growth: all components of today's release came out in the "green zone," exceeding the bold expectations of most experts. Nevertheless, despite such a strong fundamental trump card, the pound is in no hurry to strengthen its positions, at least in pair with the US currency. To the disappointment of buyers of the GBP/USD pair, the US dollar index continues to climb, reflecting increased demand for the greenback across the market. The pound is forced to react to the pressure of dollar bulls, so the pair continues to drift on the border of 20th and 21st figures.

Still, today's inflation report will remind of itself: as soon as the greenback loosens its grip, the GBP/USD bulls can use the ace up their sleeve to make an upward dash. Moreover, now there is no doubt that the Bank of England will raise the interest rate by 50 basis points at its next meeting, despite the slowdown in the UK economy in the 2nd quarter and pessimistic forecasts regarding the prospects for the 3rd and 4th quarters. In this case, the regulator will have to make a difficult, but at the same time, obvious choice: either raise the rate further, fighting inflation growth (but at the same time additionally pushing the economy into recession), or put up with a further increase in the consumer price index, abandoning aggressive measures and hoping for an increase in GDP, or at least stagnation.

Note that the volume of UK GDP in the second quarter increased by only 2.9%: for comparison, note that, in the first quarter, an increase of 8.7% was recorded. On a quarterly basis, the indicator completely went into the negative area, falling to -0.1% (against the forecast of a decline to -0.2%). If we talk about monthly growth, then there is also a rather sad picture: in June, the British economy contracted by 0.6% in monthly terms and by 0.1% in quarterly terms.

After the release of these data, there were doubts on the market that the Bank of England would decide on a 50-point increase in the rate following the results of the September meeting. Economists polled by Reuters failed to form a consensus: 30 out of 55 experts favored the most hawkish scenario. The rest allowed the rate increase by 25 points. However, all interviewed experts voiced a remark, the essence of which was that the pace of tightening monetary policy would depend on the rate of inflation growth.

That is why, today's release is so important for the GBP/USD pair. Moreover, British inflation again surprised traders with its spasmodic growth.

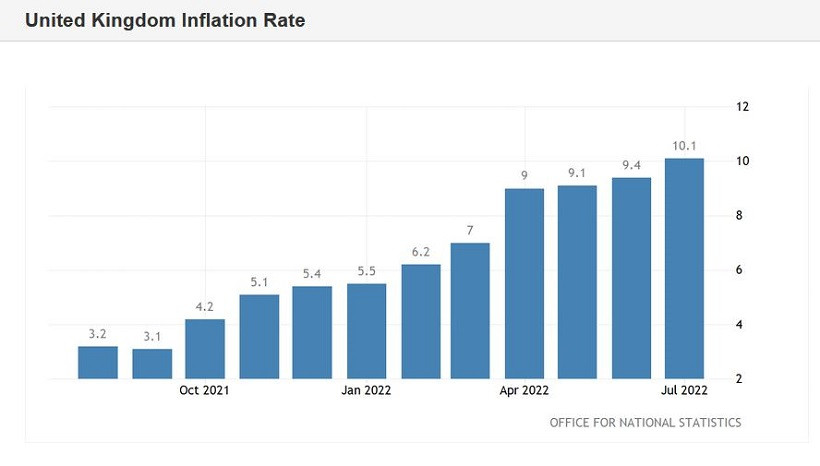

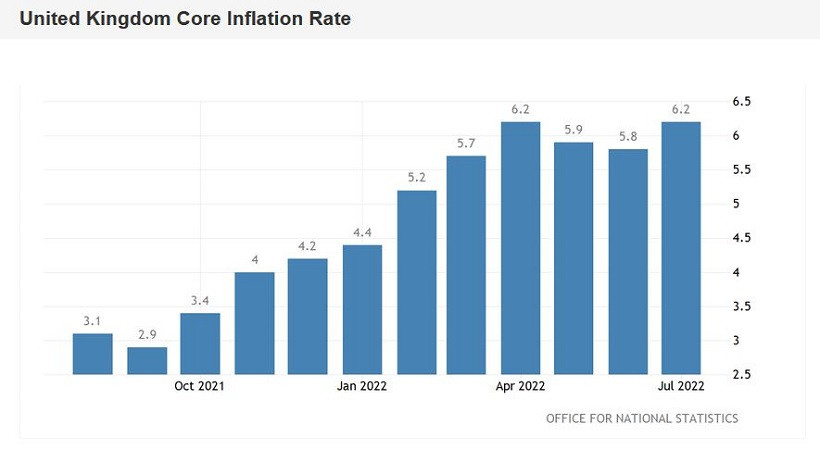

So, in July, the consumer price index reached double digits for the first time since February 1982, standing at around 10.1% in annual terms. On a monthly basis, the figure rose by 0.6%. The structure of the overall CPI suggests that the greatest contribution to the monthly growth in consumer prices was due to the rise in prices for food and non-alcoholic beverages. They have increased in price by 2.3% compared to June, and by almost 13% compared to July 2021. Such rates of rising food prices were recorded for the last time almost 14 years ago—in August 2008. Then the growth in prices for food and non-alcoholic beverages in annual terms amounted to 13.2%. The core CPI, excluding volatile energy and food prices, also surged to 6.2%. The retail price index also increased significantly, which reached a target of 12.3% in July—the maximum since March 1981.

UK Chancellor of the Exchequer Nadhim Zahawi has already commented on the published data: he said that getting inflation under control is his "top priority." Obviously, similar rhetoric will be voiced by representatives of the Bank of England, given the fact that inflation is already more than five times higher than the target of the British regulator. Strengthening the hawkish mood on the part of the Central Bank will strengthen the position of the British currency.

Some experts explain the phlegmatic reaction of the pound to today's release as a kind of trap in which the Bank of England has fallen. In their opinion, the continuing rise in the cost of living in the country, and the prospects for a further increase in energy prices, will reduce the consumer activity of Britons. This fact, in turn, will not allow the British regulator to tighten monetary policy at an aggressive pace.

In my opinion, these conclusions can be questioned here. Bank of England Governor Andrew Bailey, Central Bank Chief Economist Huw Pill, and some of their colleagues have repeatedly stated that they are ready to support "a faster pace of policy tightening if necessary." Therefore, there can be no doubt that the option of a 50-point rate increase will be the base in the context of the September meeting.

Therefore, the GBP/USD pair retains growth potential, despite the pressure of the US currency. The first target of the upward movement is the level of 1.2150—the Tenkan-sen line on the D1 timeframe. The main target is 1.2250—the upper line of the Bollinger Bands indicator, which coincides with the upper boundary of the Kumo cloud on the same timeframe.