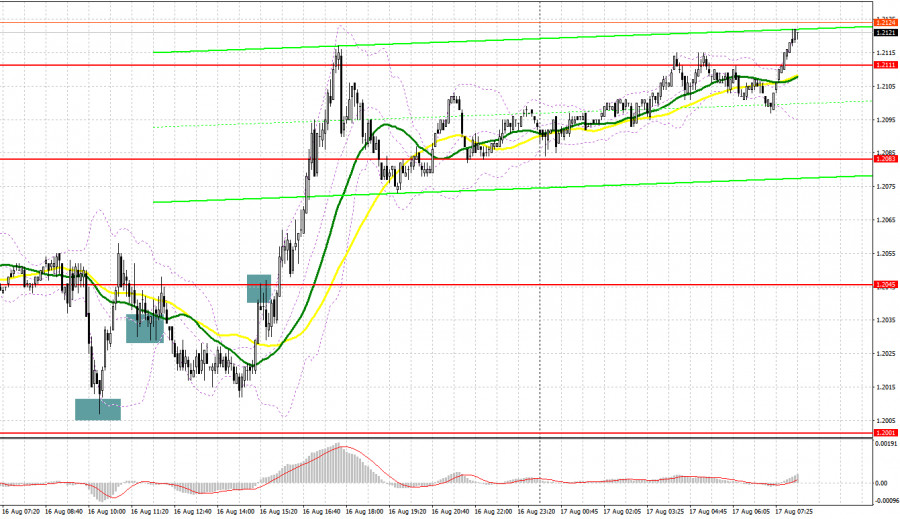

Yesterday, traders received several signals to enter the market. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the levels of 1.2034 and 1.23005 to decide when to enter the market. An immediate breakout of 1.2034 led to a sharp movement to 1.2005, where I recommended opening long positions. A false breakout gave a long signal, which allowed bulls to regain control over the market after the publication of the labor market report. Settlement and a downward test of 1.2034 was a clear signal to buy the pound sterling. However, it just led to losses. Sell orders from 1.2045 neither brought profits. After a decline of 15 pips, demand for the pound sterling revived. There were no other signals to enter the market.

Conditions for opening long positions on GBP/USD:

Today, a lot will depend on the inflation data. However, regardless of the figures, the pound sterling will remain under pressure. In any case, the UK CPI will increase. It is a negative factor for the local economy since it may lead to a decline in retail sales and slackening in the GDP growth. Notably, the Bank of England supposes that inflation may increase to 13.0% as early as by the end of this year. If the British pound declines, it is likely to touch the nearest support of 1.2099 formed earlier today. It will be better to go long after a false breakout of 1.2099. In this case, the pound/dollar pair may jump to 1.2142 to break it. A downward test of this level will lead to a new upward trend, thus allowing the pair to hit the target of 1.2179, where it is recommended to lock in profits. If the pair declines and buyers fail to protect 1.2099, pressure on the pound sterling will increase. However, nothing critical will happen. In this case, I recommend that traders avoid buy orders until the price hits the next support level of 1.2074, where there are bullish moving averages. Buy orders could be opened only after a false breakout. Long orders could be initiated just after a bounce off 1.2050 or lower – from 1.2013, expecting a correction of 30-35 pips within the day.

Conditions for opening short positions on GBP/USD:

Sellers are likely to be very aggressive as they have every chance to lose control over the market, which they gained at the end of the previous week and early this week. Data from the UK may considerably support them. It will be wise to go short amid the rise from the resistance level of 1.2142. Traders need to wait for a false breakout after the publication of the CPI report. It is expected to give a good entry point with the target at the nearest support level of 1.2099. Traders will hardly fight for this level. That is why a breakout and a reverse test of this level will give a sell signal with the target at 1.2074. There, the situation may change since pressure on the pound sterling will become lower. The next target is located at 1.050, where it is recommended to lock in profits. If the pound/dollar pair increases and bears fail to protect 1.2142, bulls will get a chance to return to 1.2179. Only a false breakout of this level will give a short signal. If bears fail to be active, the price may jump to the high of 1.2224. There, I recommend that traders sell the asset just after a rebound, expecting a decline of 30-35 pips.

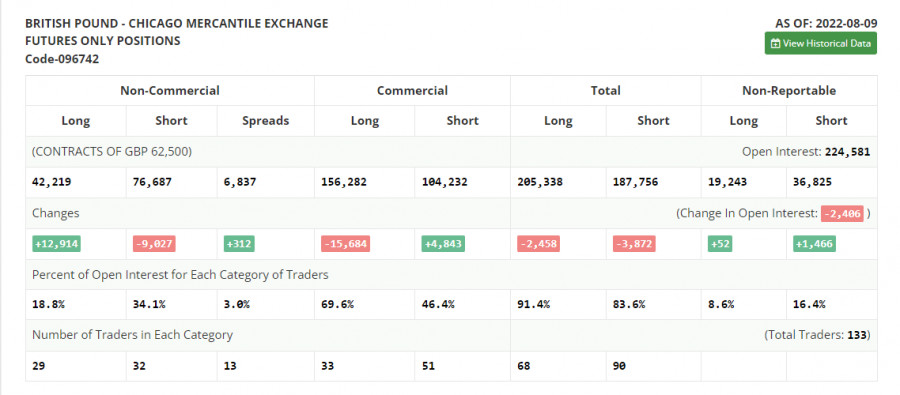

COT report

According to the COT report from August 9, the number of short positions declined, whereas the number of the long ones increased. In the second quarter, the UK GDP dropped, keeping alive the hope that the overall situation in the country will be stable despite the economic crisis. However, households still have to pay a lot, thus aggravating the cost of living crisis. Rumors that the UK economy will slide into recession are discouraging traders and investors. Notably, decisions made by the Fed have a significant influence on the pound/dollar pair. Last week, the US inflation slightly slackened, allowing traders to switch to risk assets. However, the bullish trend will hardly become stronger. It is highly likely that until the end of the month, the pair will hover within a wide channel. It will hardly reach new monthly highs. The COT report unveiled that the number of long non-commercial positions increased by 12,914 to 42,219. Meanwhile, the number of short non-commercial positions declined by 9,027 to 76,687. All this led to a reduction in the negative value of the non-commercial net position to -34,468 from -56,409. The weekly closing price decreased to 1.2038 against 1.2180.

Signals of indicators:

Moving Averages

Trading is performed above 30- and 50-day moving averages, thus pointing to the ongoing rise in the pound sterling.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger BandsIn case of a rise, the upper limit of the indicator located at 1.2142 will act as resistance.

If the pair declines, the support level will be located at the lower limit of the indicator - at 1.2050.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are a total number of long positions opened by non-commercial traders.

- Short non-commercial positions are a total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.